-

量化交易学习笔记(2) 优化突破策略

前言

在上一篇文章中,通过收盘价与SMA设计的突破策略回测结果表现十分糟糕,在本文将引入突破比例,和优化器对策略进行优化,改进策略,使其变的可以持续盈利。

策略思想

指标

使用SMA和收盘价

参数说明

X: 周期

S: 止盈比

L:止损比

C: 回调比

B:上涨幅度

N: k线数量买入信号

连续N根k线下跌

收盘价>smaX

当日收盘价>昨日收盘价

当日涨幅>B订单

交易价格:昨日收盘价*(1 - C)

止损价格: 交易价格*(1 - L)

止盈价格:交易价格*(1 + S)回测结果

参数

周期:X =100

止损:S= 0.05

止损比:L=0.01

回调比:C= 0.02

上涨幅度:B=0.04

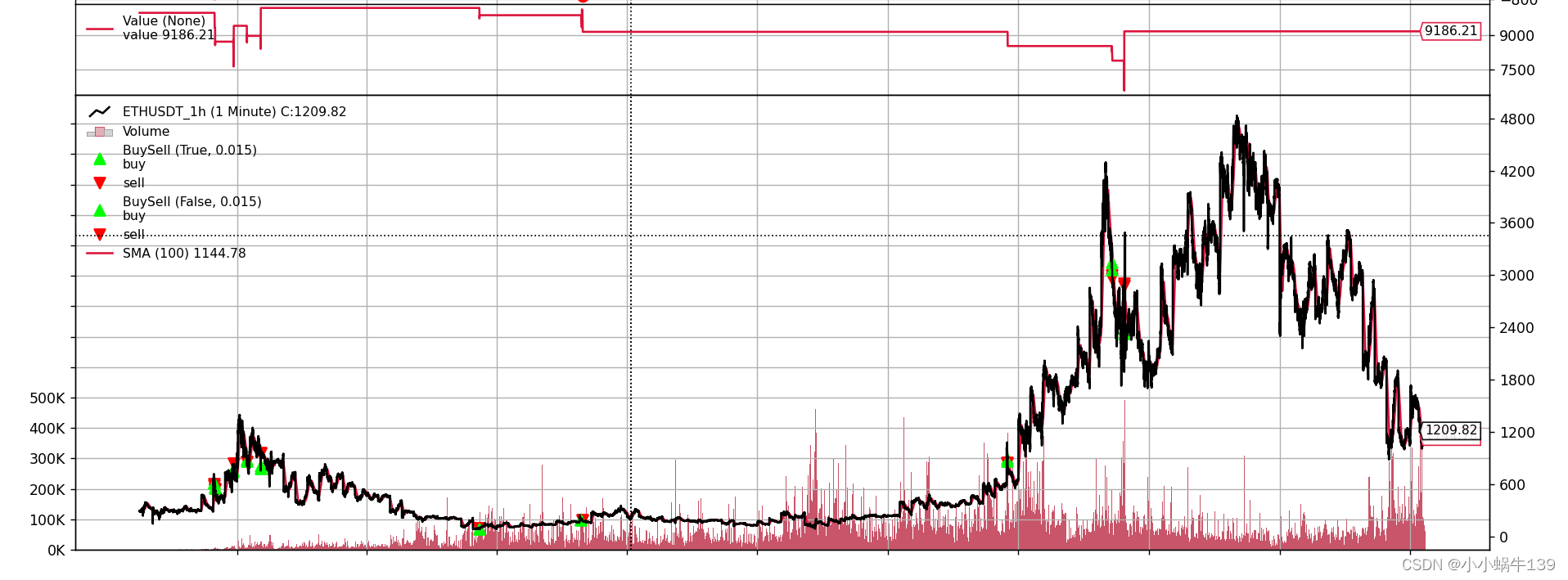

K线数量:N=5回测 Value 初始资金 10000 期货品种 ETH 时间级别 1H 回测时间 2017.7.15 - 2022.7.24 倍数 1 手续费 1% 总盈利 -813.7949095640433

优化后的参数周期:X =100

止损:S= 0.05

止损比:L=0.01

回调比:C= 0.02

上涨幅度:B=0.04

K线数量:N=5回测 Value 初始资金 10000 期货品种 ETH 时间级别 1H 回测时间 2017.7.15 - 2022.7.24 倍数 1 手续费 1% 总盈利 -813.7949095640433 核心代码

加载数据

def load_csv_data(data_path, size=None, start=None, end=None): return bt.feeds.GenericCSVData( dataname=data_path, nullvalue=0.0, fromdate=start, todate=end, dtformat="%Y-%m-%d %H:%M:%S", timeframe=bt.TimeFrame.Minutes, datetime=0, high=1, low=2, open=3, close=4, volume=5, openinterest=-1 ) def create_cerebro(cash=10000.0, commission=0.01, stake=1, strategy=None): """ :param data: 数据 :param cash: 初始资金 :param commission: 佣金率 :param stake: 交易单位大小 :param strategy: 交易策略 :return: """ cerebro = bt.Cerebro() # 设置启动资金 cerebro.broker.setcash(cash) # 设置交易单位大小 cerebro.addsizer(bt.sizers.FixedSize, stake=stake) # 设置佣金率为千分之一 cerebro.broker.setcommission(commission) # 显示回测过程中的买入和卖出信号 cerebro.addobserver(bt.observers.Value) # 显示了回测过程中的买入和卖出信号 cerebro.addobserver(bt.observers.BuySell) return cerebro- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

突破策略

import datetime import backtrader as bt from utils import load_csv_data class BreakthroughStrategy(bt.Strategy): """ """ params = dict( break_through=0.04, # 上涨幅度 callback=0.02, # 价格回调比例 period=100, # sma周期 down_day=5, # 连续下跌天数 stop_loss=0.05, # 止损比例 take_profit=0.1, # 止盈比例 validity_day=3, # 订单有效期 expired_day=1000, # 订单失效期 ) def notify_order(self, order): if order.status == order.Completed: self.holdstart = len(self) if not order.alive() and order.ref in self.orefs: self.orefs.remove(order.ref) def __init__(self): self.holdstart = None self.dataclose = self.datas[0].close # 收盘价 self.sma = bt.ind.SMA(period=self.p.period, plot=True) # SMA self.orefs = list() # order列表,用于存储尚未执行完成的订单 def next(self): # 有尚未执行的订单 if self.orefs: return # 尚未进场 # 获取近几日收盘价用于判断是否连续下跌 last_closes = list() for i in range(1, self.p.down_day + 1): last_closes.append(self.dataclose[-i]) if not self.position: # 判断十分突破 is_break = False if self.dataclose[0] > self.dataclose[-1] \ and (self.data.high[0] - self.dataclose[0]) / self.dataclose[0] > self.p.break_through: is_break = True # 连续N日下跌 在 sma上方 if last_closes == sorted(last_closes, reverse=False) and is_break and self.dataclose[0] > self.sma[0]: p1 = self.dataclose[0] * (1.0 - self.p.callback) p2 = p1 - self.p.stop_loss * p1 p3 = p1 + self.p.take_profit * p1 # 计算订单有效期 validity_day = datetime.timedelta(self.p.validity_day) expired_day = valid3 = datetime.timedelta(self.p.expired_day) size = min(self.broker.getcash() / self.data.high[0], self.data.volume) os = self.buy_bracket(size=size, price=p1, valid=validity_day, stopprice=p2, stopargs=dict(valid=expired_day), limitprice=p3, limitargs=dict(valid=valid3), ) # 保存激活的的订单 self.orefs = [o.ref for o in os] def set_params(self, params): """ 设置参数 :param params: :return: """ self.params = params- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

优化器

class BreakThroughStrategyOptimizer: # 策略参数 params = dict( break_through=0.04, # 上涨幅度 callback=0.02, # 价格回调比例 period=100, # 周期 down_day=5, # 连续下跌天数 stop_loss=0.05, # 止损比例 take_profit=0.1, # 止盈比例 ) # 调优参数范围 optimize_params = dict( break_through=[0.01, 0.4], # 上涨幅度 callback=[0.01, 0.4], # 价格回调比例 period=[20, 200], # down_day=[2, 20], # 连续下跌天数 stop_loss=[0.01, 0.4], # 止损比例 take_profit=[0.01, 0.4], # 止盈比例 ) def __init__(self): # 数据 self.data = None # 持有现金 self.cash = 10000.0 # 资产 self.value = 10000.0 self.cerebro = None # 迭代次数 self.event_num = 500 def log(self, txt): """ 日志记录 :param txt: :return: """ print(txt) def set_data(self, feed_data): """ 设置数据 :param feed_data: :return: """ self.data = feed_data def get_data(self): """ 获取数据 :return: """ return self.data def get_optimize_total_assets(self): """ 获取最优策略回测后的总资产 :return: """ self.params_optimize( break_through=self.params['break_through'], callback=self.params['callback'], down_day=self.params['down_day'], period=self.params['period'], stop_loss=self.params['stop_loss'], take_profit=self.params['take_profit'], is_show_plot=False ) return self.cerebro.broker.getvalue() def params_optimize(self, break_through, callback, down_day, period, stop_loss=0.05, take_profit=0.01): """ 参数优化 :param down_day: 连续下跌天数 :param period: 周期 :param break_through: 突破比例 :param callback: 价格回撤 :param stop_loss: 盈亏比 止损 :param take_profit: 盈亏比 止盈 """ kines = self.get_data() self.cerebro = create_cerebro(self.cash) self.cerebro.adddata(kines) self.cerebro.addstrategy(BreakthroughStrategy, break_through=break_through, callback=callback, period=int(period), down_day=int(down_day), stop_loss=stop_loss, take_profit=take_profit) self.cerebro.run() rate = self.cerebro.broker.getvalue() / self.cash if rate > 10: self.log(f"rate: {rate} ") self.log(f"break_through:{break_through}") self.log(f"callback: {callback}") self.log(f"period: {period}") self.log(f"down_day: {down_day}") self.log(f"stop_loss: {stop_loss}") self.log(f"take_profit: {take_profit}") self.log(f"asset: {(self.cerebro.broker.getvalue())}") self.log("") return self.cerebro.broker.getvalue() def run(self): opt = optunity.maximize( f=self.params_optimize, num_evals=self.event_num, solver_name='particle swarm', break_through=[0.01, 0.4], callback=[0.01, 0.4], down_day=[2, 20], period=[20, 200], stop_loss=[0.02, 0.2], take_profit=[0.02, 0.4] ) optimal_pars, details, _ = opt # optimal_pars 最优参数组合 self.params = optimal_pars print(self.params) def get_trader_info(self): return 'Starting Portfolio Value: %.2f \n' % self.cash \ + 'Final Portfolio Value: %.2f \n' % self.cerebro.broker.getvalue() \ + f'Final Portfolio Percentage: {100.0 * self.cerebro.broker.getvalue() / self.cash} %\n' \ + f'PARAMS {self.params}\n' def get_optimal_parameters(self): """ 获取最优参数 :return: """ return self.params- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

运行策略

if __name__ == '__main__': path = "D:\\work\\git\\Tools\\static\\data\\ETHUSDT_1h.csv" data = load_csv_data(path) cerebro = create_cerebro() cerebro.adddata(data) cerebro.addstrategy(BreakthroughStrategy) cerebro.run() print(".2f" % cerebro.broker.getvalue() - 10000) cerebro.plot()- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

运行优化器

if __name__ == '__main__': path = "D:\\work\\git\\Tools\\static\\data\\ETHUSDT_1h.csv" k_data = load_csv_data(path, datetime.datetime(2021, 1, 1), datetime.datetime(2021, 12, 1)) optimizer = BreakThroughStrategyOptimizer() optimizer.set_data(k_data) optimizer.run()- 1

- 2

- 3

- 4

- 5

- 6

总结

目前从回测结果来看,该策略在破产的的边缘试探,表现结果十分糟糕。下一篇文章会对该策略进行优化,使策略可持续盈利,加油!!!!

-

相关阅读:

k8s简介

使用 JPA、Hibernate 和 Spring Data JPA 进行审计

从浏览器输入一个URL到最终展示出页面,中间会发送哪些事儿?

开源网安受邀参加网络空间安全合作与发展论坛,为软件开发安全建设献计献策

EasyExcel 复杂数据导出

Excel - 插入空白行

MyBatis-Plus(详解)

榜样力量激发青少年英语学习新活力

HTML5+CSS3+JS小实例:带密码灯照射的登录界面

《入门级-Cocos2dx4.0 塔防游戏开发》---第十一课:游戏地图信息初始化

- 原文地址:https://blog.csdn.net/weixin_43688870/article/details/126132259