-

K线形态识别_冉冉上升

写在前面:

1. 本文中提到的“K线形态查看工具”的具体使用操作请查看该博文;

2. K线形体所处背景,诸如处在上升趋势、下降趋势、盘整等,背景内容在K线形态策略代码中没有体现;

3. 文中知识内容来自书籍《K线技术分析》by邱立波。目录

解说

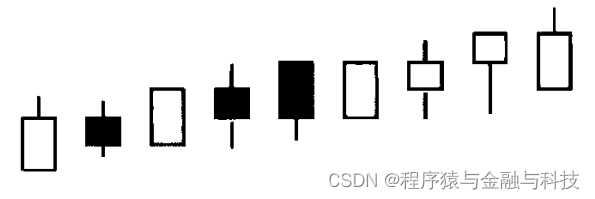

冉冉上升形式指在上涨初期或盘整后期,股价或指数收出若干夹着一些小阴线、十字线的小阳线(一般不少于8根),整体走势略向上倾斜的K线组合形态。

技术特征

1)出现在上涨初期或盘整后期。

2)由若干小K线组成(一般不少于8根)。

3)一般以小阳线居多,中间也可以夹着一些小阴线、十字线。

4)K线组合形态排列略向上倾斜。

技术含义

冉冉上升是买进信号,后市看涨。

冉冉上升的意思是股价就像东方升起的朝阳,涨速虽然很慢,毫不起眼,但却往往是后市股价大涨的预兆。

冉冉上升的走势说明多方的推升正在有条不紊地进行,很多情况下是有主力介入的表现。因为主力买入必然导致买盘增加,股价上升。如果股价上升过快,或者某一日涨幅过大,都会引起其他交易者的关注和跟风。这样既增大了主力吃货的成本,也不利于主力日后拉升和派发,因此很多主力都会刻意隐藏吸货意图。但股价走势往往在不知不觉中暴露其行踪。至于公众交易者是否能够发现,那就要看谁能够用心聆听K线的细语。

k线形态策略代码

- def excute_strategy(daily_file_path):

- '''

- 名称:冉冉上升

- 识别:

- 1. 股价或指数收出若干(至少8根)夹着一些小阴线、十字线、小阳线,小阳线居多

- 2. K线组合形态排列略向上倾斜

- 自定义:

- 1. 略向上倾斜 =》

- 1)第一根与后面的K线斜率为正的占比要大于三分之二

- 2)第一根与最后一根斜率要大于前面所有的斜率

- 前置条件:计算时间区间 2021-01-01 到 2022-01-01

- :param daily_file_path: 股票日数据文件路径

- :return:

- '''

- import pandas as pd

- import os

- start_date_str = '2021-01-01'

- end_date_str = '2022-01-01'

- df = pd.read_csv(daily_file_path,encoding='utf-8')

- # 删除停牌的数据

- df = df.loc[df['openPrice'] > 0].copy()

- df['o_date'] = df['tradeDate']

- df['o_date'] = pd.to_datetime(df['o_date'])

- df = df.loc[(df['o_date'] >= start_date_str) & (df['o_date']<=end_date_str)].copy()

- # 保存未复权收盘价数据

- df['close'] = df['closePrice']

- # 计算前复权数据

- df['openPrice'] = df['openPrice'] * df['accumAdjFactor']

- df['closePrice'] = df['closePrice'] * df['accumAdjFactor']

- df['highestPrice'] = df['highestPrice'] * df['accumAdjFactor']

- df['lowestPrice'] = df['lowestPrice'] * df['accumAdjFactor']

- # 开始计算

- df['type'] = 0

- df.loc[df['closePrice'] >= df['openPrice'], 'type'] = 1

- df.loc[df['closePrice'] < df['openPrice'], 'type'] = -1

- df['body_length'] = abs(df['closePrice']-df['openPrice'])

- df['small_type'] = 0

- df.loc[df['body_length']/df['closePrice'].shift(1)<0.015,'small_type'] = 1

- df['ext_0'] = df['small_type'] - df['small_type'].shift(1)

- df['ext_1'] = df['small_type'] - df['small_type'].shift(-1)

- df.reset_index(inplace=True)

- df['i_row'] = [i for i in range(0, len(df))]

- df_m_s = df.loc[df['ext_0'] == 1].copy()

- df_m_e = df.loc[df['ext_1'] == 1].copy()

- i_row_s = df_m_s['i_row'].values.tolist()

- i_row_e = df_m_e['i_row'].values.tolist()

- i_row_two = i_row_s + i_row_e

- i_row_two.sort()

- df['signal'] = 0

- df['signal_name'] = ''

- for s, e in zip(i_row_s, i_row_e):

- if e - s < 8:

- continue

- enter_yeah = True

- last_smaller = False

- rate_p_num = 0

- last_chg = df.iloc[e]['closePrice'] - df.iloc[s]['closePrice']

- for i in range(e,s,-1):

- cur_chg = df.iloc[i]['closePrice'] - df.iloc[s]['closePrice']

- if cur_chg > last_chg:

- last_smaller = True

- break

- if cur_chg>0:

- rate_p_num += 1

- pass

- if last_smaller:

- continue

- if float(rate_p_num)/(e-s) < 0.66:

- enter_yeah = False

- if enter_yeah:

- df.loc[(df['i_row'] >= s) & (df['i_row'] <= e), 'signal'] = 1

- df.loc[(df['i_row'] >= s) & (df['i_row'] <= e), 'signal_name'] = str(e - s)

- pass

- file_name = os.path.basename(daily_file_path)

- title_str = file_name.split('.')[0]

- line_data = {

- 'title_str':title_str,

- 'whole_header':['日期','收','开','高','低'],

- 'whole_df':df,

- 'whole_pd_header':['tradeDate','closePrice','openPrice','highestPrice','lowestPrice'],

- 'start_date_str':start_date_str,

- 'end_date_str':end_date_str,

- 'signal_type':'duration_detail',

- 'duration_len':[],

- 'temp':len(df.loc[df['signal']==1])

- }

- return line_data

结果

-

相关阅读:

2022年ccpc威海站

富格林:总结阻挠欺诈解决措施

WebGL 与 WebGPU比对[6] - 纹理

java进阶(七)------多线程---多线程操作同一变量

linux base64编码、解码

【BW16 应用篇】安信可BW16模组/开发板AT指令实现HTTP通讯

前端性能优化

CoFSM基于共现尺度空间的多模态遥感图像匹配方法--论文阅读记录

基于mindspore的大模型llama2-7b---微调/推理

【区块链 | ENS】ENS中的Namehash加密逻辑

- 原文地址:https://blog.csdn.net/m0_37967652/article/details/127740625